indiana estate tax return

The types of taxes a deceased taxpayers estate can owe are. Individual trust guardian or estate.

Long Delayed Indiana Tax Rebate Checks Will Be Larger

Please read carefully the general instructions before preparing.

. The executor administrator or the surviving spouse must file an Indiana income tax return for the individual if. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note. To 430 pm Monday through Friday with the exception of.

Fill-in pdf IT-41 Schedule IN K-1. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. 55891 Beneficiarys Share of Indiana Adjusted Gross. 50217 Fiduciary Payment Voucher 0821.

Indiana estate tax return Wednesday August 31 2022 Edit. Do not file Form IH-6 with an Indiana court having probate. Preparation of a state tax return for Indiana is available for 2995.

This tax return is used by the fiduciary representative to report the income deductions gains losses etc. The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO. E-File is available for Indiana.

Indiana Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers state-specific forms and templates in Word and PDF format that you can instantly download fill. The deceased was under the age of 65 and had adjusted gross income more. For more information check our list of inheritance tax forms.

Inheritance tax was repealed for individuals dying after December 31 2012. 4810 for Form 709 gift tax only. Please direct all questions and form requests to the above agency.

Know when I will receive my tax refund. All district offices have hours from 8 am. Indiana Fiduciary Income Tax Return 0821 fill-in pdf IT-41ES.

If you are filing a. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing. Find Indiana tax forms.

Income Tax Return for Estates and Trusts. Of the estate or trust. If you are filing a calendar-year return please enter the 4-digit tax year in the box YYYY.

Contact a district office of the Indiana Department of Revenue see Resources. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. The income that is.

Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. Box 71 Indianapolis IN 46206-0071. Taxpayer as shown on Form 1041 US.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Does Indiana Have an Inheritance Tax or Estate Tax. Direct Deposit is available for Indiana.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Department of the Treasury. Indiana Estate Planning Elder Law Hunter Estate Elder Law is an estate planning and elder law firm with a focus on asset protection wills trusts Medicaid planning Veterans benefits.

Therefore no inheritance tax returns must be filed at this time.

State Death Tax Hikes Loom Where Not To Die In 2021

Guidelines For An Executor Of An Estate In Indiana Indianapolis Estate Planning Attorneys

Indiana Estate Planning Elder Law Taxes

New Irs Form 8971 Rules To Report Beneficiary Cost Basis

Understanding The Estate Tax Return Marotta On Money

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

New Irs Requirements To Request Estate Closing Letter

Indiana State Tax Information Support

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

How Indiana Probate Law Works Probate Advance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

10 Ways To Reduce Estate Taxes Findlaw

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

Fillable Online Motion To Show Cause Fillable Form Indiana Fax Email Print Pdffiller

How Long Does Probate Take In Indiana

Indiana Property Tax Calculator Smartasset

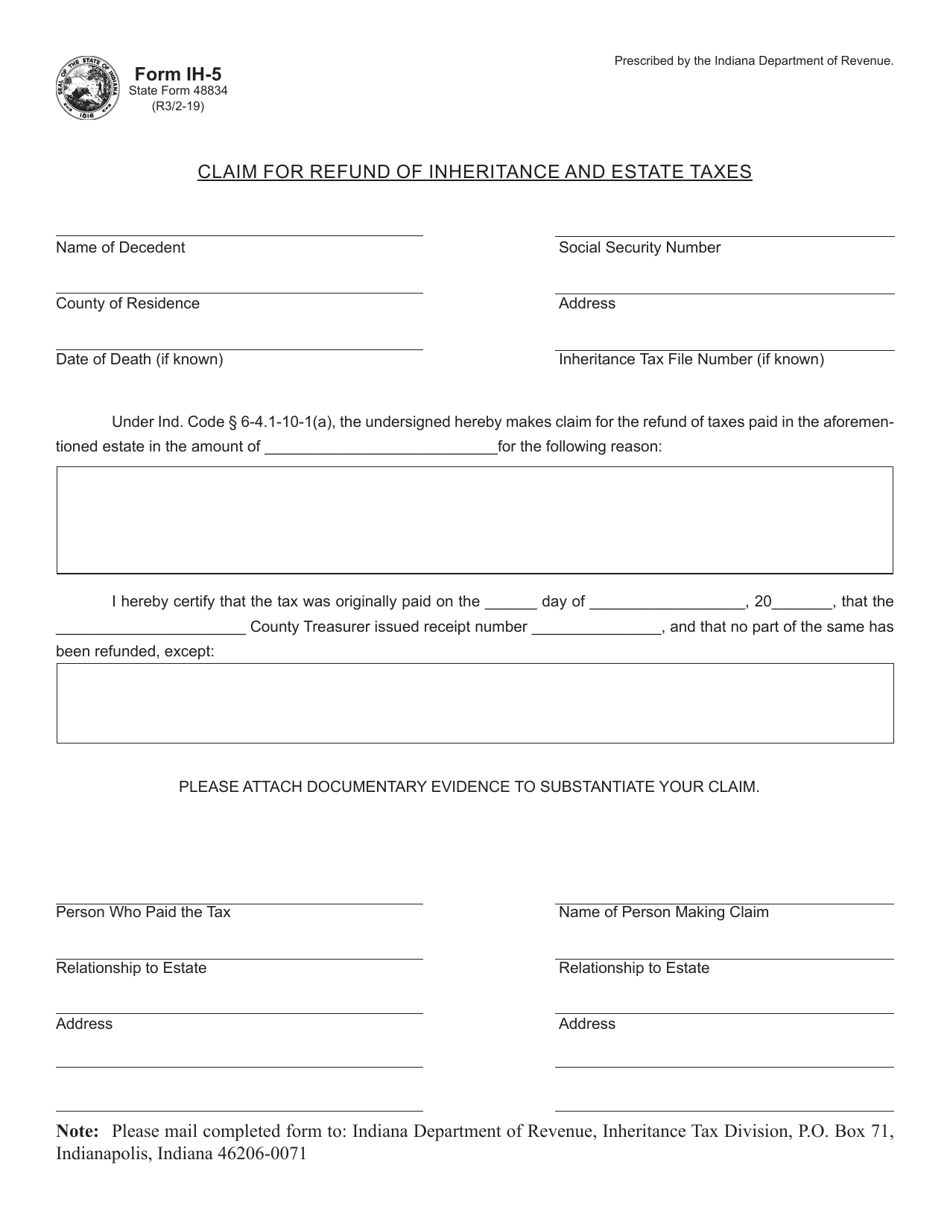

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller